This article is part of our coverage of HYBE vs. ADOR CEO Min Hee Jin. You can read more and view the entire timeline here.

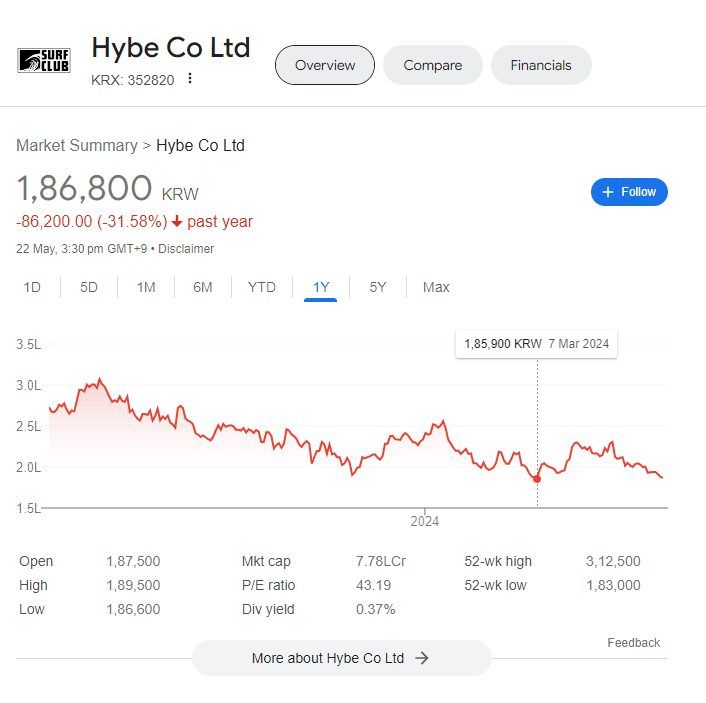

K-Pop industry’s biggest player, HYBE, is facing unprecedented drops in its stock prices amidst the many ongoing controversies within the corporation.

Recently, HYBE became the first entertainment company in Korea to become a conglomerate, as its assets reportedly surpassed over ₩5.00 trillion KRW (about $ 3.67 billion USD). The multi-label corporation, however, is showing signs of a slowdown as its stock prices continue to take a steep dive.

HYBE’s shares have shown signs of a serious downward spiral since the company’s public fallout with its subsidiary, ADOR, started catching fire. Apart from the label’s feud with CEO Min Hee Jin, HYBE has also been criticized recently for poor management of artists and questionable associations with executives like Scooter Braun and Lucian Grainge.

Though it is difficult to pontificate the exact reasons, HYBE’s stock prices have recently plummeted below ₩190,000 KRW (about $ 139 USD). On May 21, KST, it closed at ₩190,000 KRW (about $ 139 USD), and on May 22, KST, it went down further, at ₩187,000 KRW (about $ 137 USD). Notably, the price is very close to the lowest recorded value of HYBE shares in 2024, which was ₩186,000 KRW (about $ 136 USD) on March 7.

With the growing dislike towards HYBE among the general public, netizens seem to be happy with this downgrade of HYBE stocks. A post on the popular online community, Theqoo, went viral after pointing out the price drop, with many either celebrating or hoping for a further decrease in value.

- “Looking at what they’re doing, it should drop even more.”

- “Whoa…”

- “This is really the fault of the owner who made something that should have been resolved quietly into a media frenzy.”

- “I think it was f*cking inflated all this while.”

- “Let’s go even lower!”

- “The owner risk of making a big fuss out of something that could’ve been wrapped up quietly.”

- “It should be around 80,000 won.”

Notably, it is not just HYBE stock prices that seem to have taken a hit, the company’s net profit has also shown visible decline in its Q1 report of 2024. Despite the Korean labels performing well, HYBE’s net profit during this quarter has been 0.8%, with subsidiaries like HYBE America, HYBE x UMG, Weverse, And HYBE IM incurring over ₩5.00 billion KRW (about $ 3.67 million USD) each in losses. You can read more about HYBE’s performance in comparison to other Big4 labels here.

Source: Theqoo