French startup Carbonfact believes that the best carbon accounting solutions will focus on one vertical. That’s why the company has decided to provide a carbon management and reporting tool for the fashion industry exclusively.

Carbonfact recently raised a $ 15 million funding round led by Alven, a French VC firm that also led the startup’s seed round in 2022. Other investors in the round include Headline and Y Combinator, which also did a follow-on investment.

Big companies in the fashion industry (and other industries) need to come up with a carbon accounting strategy as regulation is changing in Europe and the U.S. — the EU’s Corporate Sustainability Reporting Directive (CSRD), California’s Climate Corporate Data Accountability Act, and the NY Fashion Act all require extensive tracking and reporting of how sustainability issues affect a company’s business.

That’s why there has been a boom in carbon accounting platforms. The biggest ones, like Watershed, Persefoni, Sweep or Greenly, have an industry-agnostic approach. They help you track your carbon emissions and create reports in a more or less automated way.

But in a manner similar to Carbon Maps, which focuses exclusively on the food industry, Carbonfact is focusing on the fashion industry so that its product can be more granular and more specific.

“For these industries — food is a very good example, fashion is a very good example — you need to be accurate in your calculations. You need industry-specific tools to model virtual products and improve your product offering in the future,” Carbonfact’s co-founder and CEO, Marc Laurent, told TechCrunch in an interview.

Carbon data at the product level

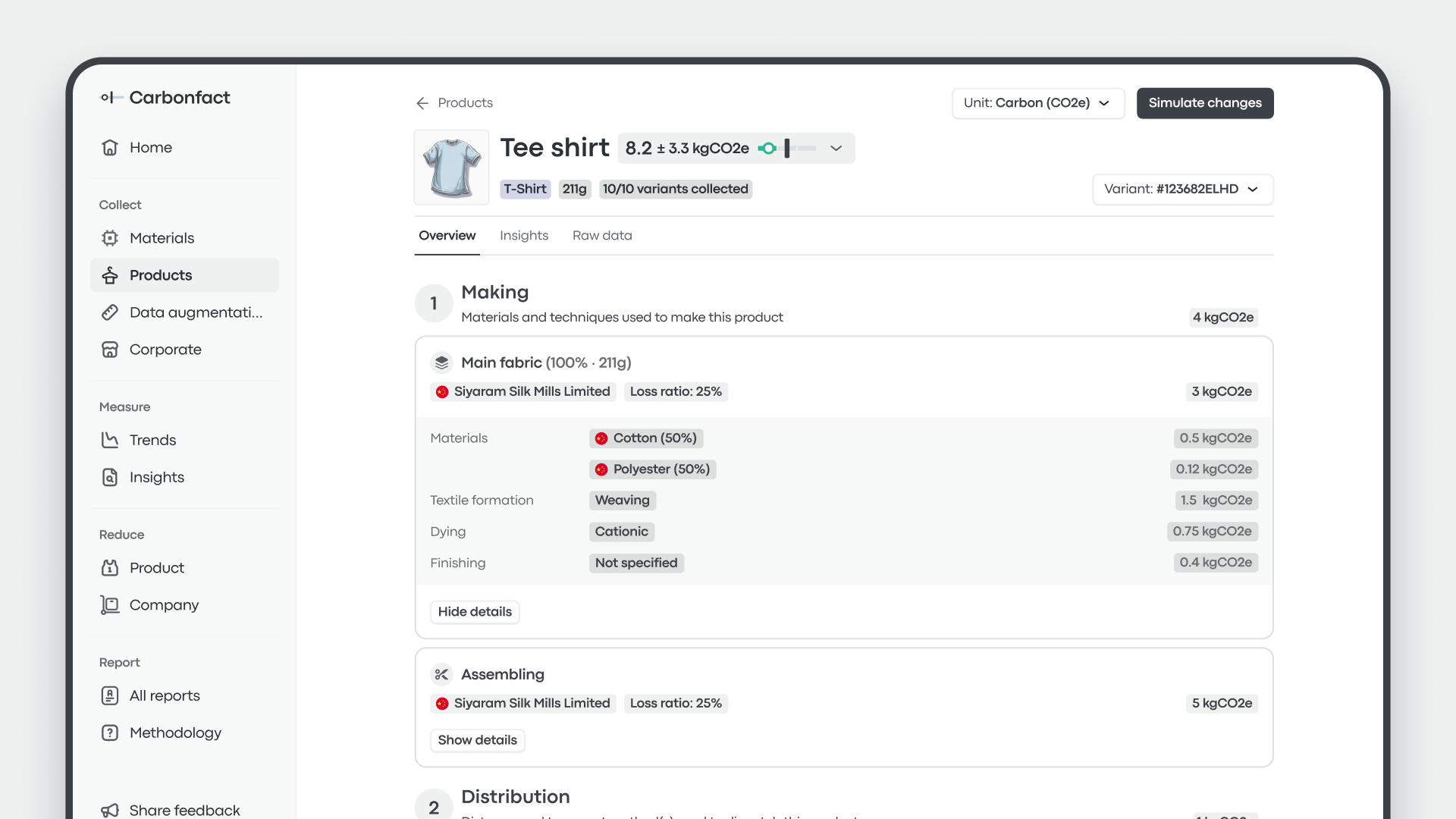

Carbonfact retrieves companies’ data from their ERP and other internal systems, and then calculates the footprints for each product using a lifecycle assessment engine that is specifically designed for clothing items.

“[Clients] also have data in what they call PLM [Product Lifecycle Management software ] — that’s the software in which they put all the product data. This is where you’ll find the product recipe sheets. They sometimes have data in traceability platforms, such as Retraced, Trustrace, Fairly Made in France, etc. And finally, they sometimes have data in Excel files,” Laurent said.

After centralizing and normalizing all that data in a single platform, as the fashion industry relies on a cascade of suppliers, Carbonfact wants to help companies calculate their scope 1, 2 and 3 emissions. Scope 3 emissions, in particular, encompass indirect emissions from third-party suppliers.

The startup first gives its clients a broad idea of their main emission hotspots with an uncertainty range. It then helps them prioritize data collection with suppliers to refine the data and improve carbon reporting.

After that, Carbonfact can become a customer’s carbon footprint dashboard. It lets you generate broad reports and drill down at the SKU level to see the environmental cost of each product. The platform can then be used to run “what-if” scenarios to see if you should change a material, move to a new country of manufacturing, or change your transport methods.

Image Credits: Carbonfact

While many companies will focus first on CO2-equivalent metrics, Carbonfact can also be used to track other metrics, such as water consumption, French eco-labels, and other environmental indicators. In the carbon accounting industry, they call these indicators the Product Environmental Footprint Category Rules, or PEFCR for short.

Carbonfact has already onboarded over 150 apparel and footwear brands, including New Balance, Columbia, Carhartt and Allbirds. “We track 100% of their subsidiaries, 100% of their suppliers, 100% of their products,” Laurent said.

Each client pays tens of thousands of dollars per year to use Carbonfact. With a little back-of-the-envelope calculation, if we consider that a client pays around $ 20,000 per year on average, it means that the French startup already generates at least $ 3 million in annual recurring revenue.

It’s clear that sustainability management software is a growing segment in the world of enterprise software. Still, it’s also a young sector. So it’s going to be interesting to see if several industry-specific platforms can become large companies, or if there will be some consolidation down the road.