High-flying venture investors in India managing hundreds of millions of dollars are tempering expectations, making early-stage startup bets that in best-case scenarios they hope will return 3 to 5 times invested capital.

Several leading India investors including Peak XV Partners, Elevation Capital, Lightspeed, Nexus and Accel have raised $ 500 million-plus in the past two years, emboldened by earlier home runs and vast market potential.

However, the prevailing mood has shifted this year. Investors increasingly caution they struggle to spot truly fund-returning prospects — the latest headache confronting the world’s most populous nation. (A VC with a recently raised fund below $ 250 million asserted that investment firms wielding $ 500 million or more in capital reserves face greater difficulty deploying those assets profitably.)

VC firms generally make between 20 to 30 investments per fund, betting on a select few startups that can potentially generate outsized returns to compensate for other losses. These firms aim to have 2-3 of their portfolio companies drive the majority of a fund’s capital gains. This strategy of pursuing high-risk, high-reward deals is especially common among early-stage investors who allocate most of their fund capital into young startups in hopes of getting in early on the next big thing.

The glut of capital has led India investors to turn abnormally cautious and choosy, founders and investors said. Firms are scrutinizing deals at Series A and B stages for up to 6 months now, said an investment banker, when such deals once took far less diligence. India’s sovereign fund has been evaluating an investment in agritech startup WayCool for more than six months at this point, according to two people familiar with the matter. Gaming startup Loco has also held talks with investors to raise about $ 80 million, but more than six months later no deal has materialized.

Bessemer Venture Partners’ India team has inked just one new net deal this year, according to people familiar with the matter. One investor remarked that Bessemer is taking months and months in due diligence and maintaining a high level of skepticism.

Anant Vidur Puri, a partner at Bessemer Venture Partner, confirmed the firm has only done one net new investment in India this year, saying the fund is “roadmap focused” that looks to build a concentrated portfolio of high-quality investments and often likes to double down on existing backings.

“We are also stage agnostic so can come in at Seed, Series A, B or C and look to continue to back our investments over stages, consistent with the concentrated portfolio strategy. Some years we do 6-7 new deals and some years we do 0 as well which could depend on when we see attractive and compelling investments in the market, but on an average we don’t do more than a handful of new investments each year,” he told me in a text message.

Mirroring the sluggish investment pace in startup ecosystems globally, Indian startups have secured roughly $ 7 billion in capital in 2022, indicating a slowdown compared to prior years, according to market intelligence platform Tracxn, down from about $ 25 billion in 2022 and $ 37 billion in 2021. In fact, it’s the lowest since 2016. (Only one Indian startup — Zepto — entered the unicorn club this year.)

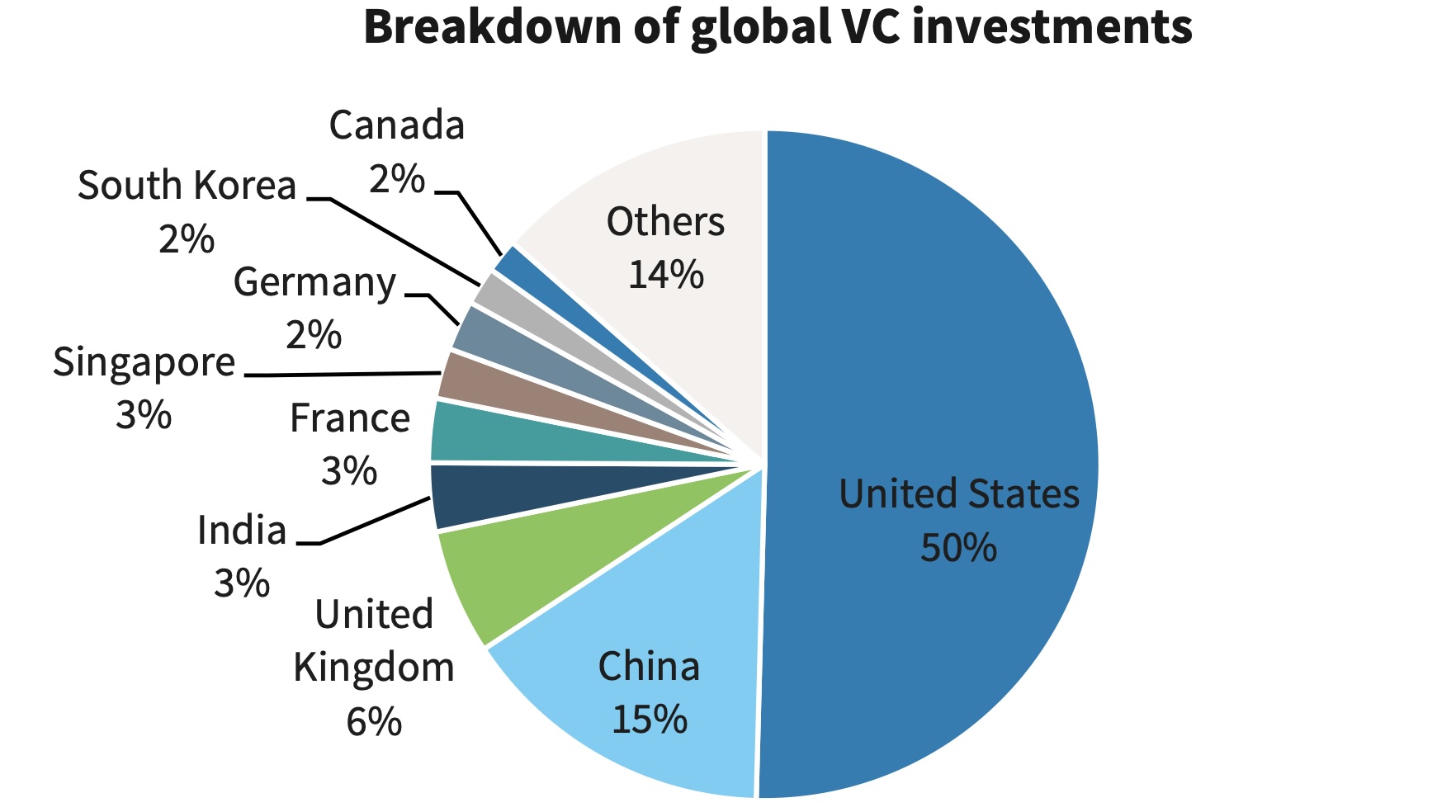

Top VC markets, by volume of investment in 2023. (Data: Pitchbook and Barclays)

Some investors said they are taking more precautions because of the dwindling value of many of the top Indian startups, something they say has forced them to rebuild their market thesis for India.

Prosus recently slashed the valuation of Byju’s to below $ 3 billion. (Byju’s, which has raised over $ 5 billion to date, was valued at $ 22 billion early last year.) Pharmeasy, once valued at $ 5.4 billion, recently raised capital at a 90% discount. Vanguard has cut the valuation of ride-hailing giant Ola by more than 60%. Food delivery giant Swiggy, merchant payments platform Pine Labs, and SaaS Gupshup have all also faced write-downs this year. Reliance and Google-backed Dunzo, which has raised more than $ 500 million, is struggling to make payroll, and BNPL startup ZestMoney, which raised over $ 130 million, is shutting down.

India-focused investors are also increasingly growing bearish on Southeast Asia. In recent years, firms like Peak XV and Lightspeed expanded into the region, backing many early-stage startups, some of which became big winners.

However, some large investors now harbor apprehensions, saying too much capital chases too few viable Southeast Asia deals, inflating valuations and diminishing potential returns. (In a recent interview, Peak XV said it remains very bullish on Southeast Asia.)

Investors also question whether they have overestimated India’s SaaS opportunity. “Everyone underwrote product risk, companies were able to build products. No one has been able to sell/scale revenue beyond a meaningful point,” a U.S.-based early-stage India investor said, adding that very few companies have been able to break into American networks to sell to U.S. companies.

Dev Khare of Lightspeed Venture Partners India said there have been fewer than 100 transactions for Indian enterprise software startups across seed through growth in 2023. The market remains very focused on seed transactions, and the Series A round is the “chokepoint.”

“Hundreds of seeds done in India in 2021/2022 are finding it hard to break into enterprise budgets given contraction in budgets and/or many are me-too’s/light features,” he wrote.