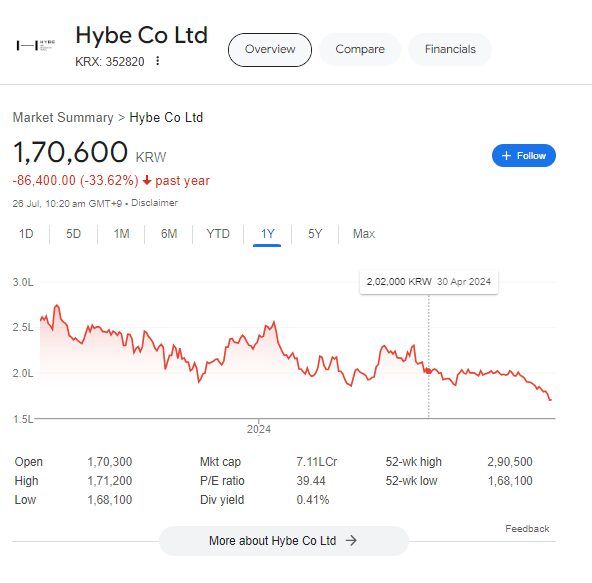

In the previous few months, HYBE’s struggles in the financial market have made headlines repeatedly. The company’s stock prices are seeing an unprecedented low after it announced that Lee Jae Sang, the company’s CSO (chief strategy officer), will replace Park Ji Won as the new CEO.

Lee’s appointment was already not favored by fan communities as his past scandals resurfaced within hours of the news. It seems that the stock market also hasn’t responded kindly to this sudden power change in the conglomerate. On Thursday, July 25, KST, HYBE stock hit its lowest price in 18 months, just a day after Lee was announced as the new CEO.

On Thursday, HYBE shares closed at ₩170,000 KRW (about $ 123 USD), the worst price recorded since January 2023, when it was just recovering after BTS’s hiatus announcement. HYBE is yet to hold its shareholder and board meetings where it said it would pass an item to appoint Lee Jae Sang as the company’s new CEO. He joined the company in 2018 when HYBE was still Big Hit Entertainment.

Right after Lee’s appointment was disclosed to the public, community sites were abuzz with multiple allegations against him, including “threatening” ADOR’s former vice president and coercing them into revealing private conversations with CEO Min Hee Jin. Another criticism levied against Lee regarding his role in acquiring Ithaca Holdings while he was the CEO of HYBE America and co-establishing an NFT company to create NFTs using HYBE artists.

After buying Ithaca in 2021, HYBE America has logged annual net losses for two consecutive years, amounting to ₩70.1 billion KRW (about $ 50.8 million USD) and ₩142 billion KRW (about $ 103 million USD), respectively. On the other hand, HYBE America’s investment in the NFT company Levvels also generated an operating loss of ₩18.0 billion KRW (about $ 13.0 million USD) in 2023, followed by a ₩3.50 billion KRW (about $ 2.53 million USD) loss during the first quarter of 2024.