Building a high-growth SaaS company is never easy, but founders who are feeling like the job is more challenging than ever aren’t imagining things — economic shifts over the past two years have profoundly impacted the landscape.

In 2023, SaaS companies’ year-over-year growth rate plummeted to its lowest point in the past five years. As a result, organizations scrambled to secure their financial footing through hiring freezes and RIFs, optimizing toolset utilization, and introducing performance management initiatives. However, finding the thin line between managing costs while continuing to fuel growth is highly nuanced, requiring an evolved approach to monitoring and measuring business health.

When cost-cutting isn’t practical, it becomes clear that more creative changes are needed to right the ship. Adapting to this new reality requires the industry to reassess how to measure success and what to measure. Traditional success metrics like the Rule of 40 and Magic Number must be revised amid an unpredictable and competitive market.

But if the old playbook no longer applies, how can companies benchmark their performance for our new normal? As head of analytics at ICONIQ Growth, I have spoken to and surveyed nearly 100 top-performing SaaS companies and analyzed more than 10 years of their operating and financial data that is not available to the general public. These companies span from $ 1 million ARR to post-IPO, providing the most transparent view of the SaaS industry at every stage.

What we learned could fill a book (and indeed, our Topline Growth and Operational Efficiency report spans nearly 70 pages of insights). Still, we felt it was important to summarize some of the fundamental shifts in strategy that SaaS companies should consider adopting in 2024 to unlock growth and new industry benchmarks that will help these teams get a more accurate picture of how their performance stacks up in today’s environment.

Reassessing pricing models to unlock growth

Traditional success metrics like the Rule of 40 and Magic Number must be revised amid an unpredictable and competitive market.

Traditional licensing and seat-based pricing have long been the go-to model for SaaS companies. While this approach may serve most companies well at first, it could mean leaving money on the table in the long run.

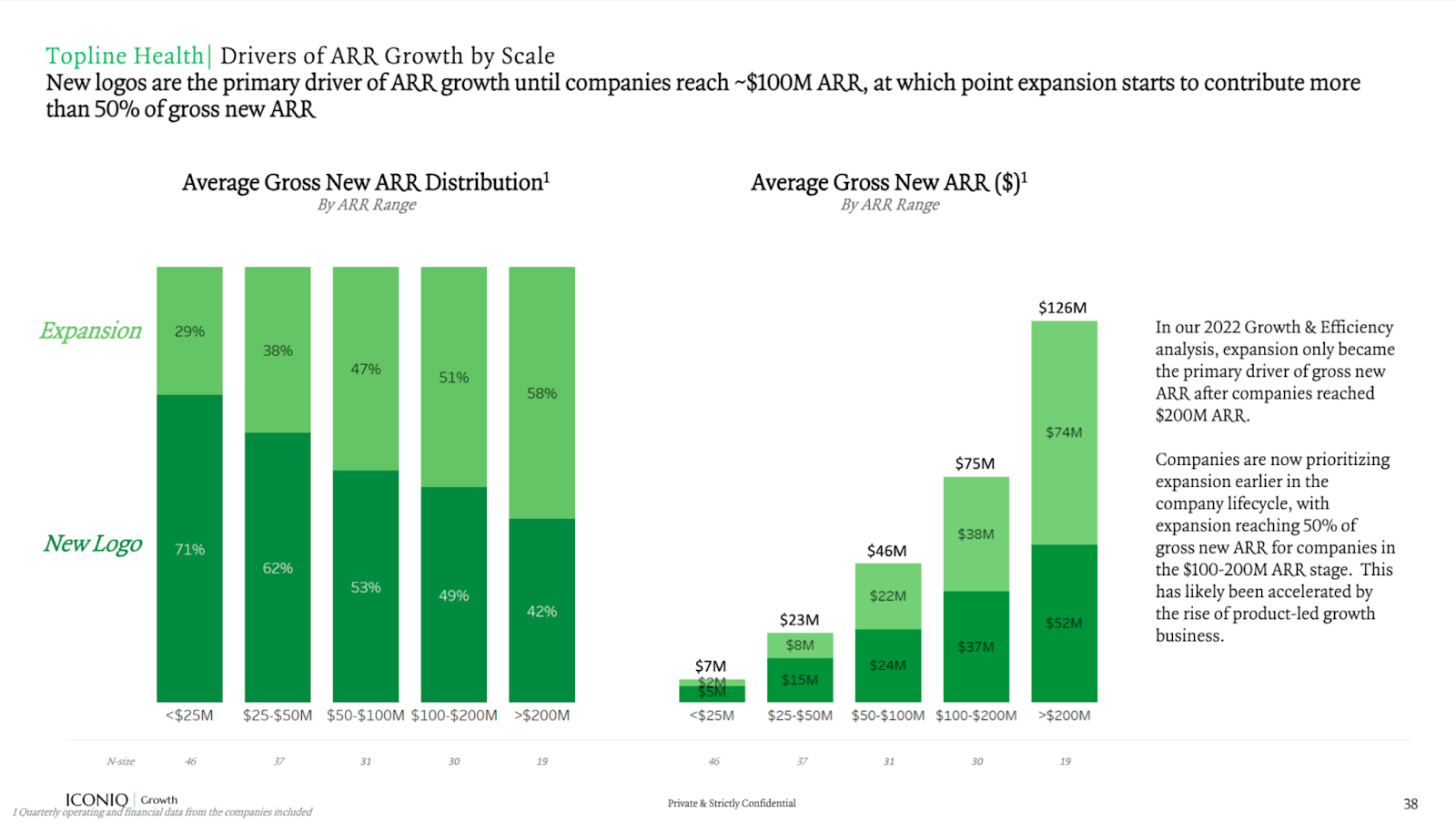

Our research shows that growth rate decreases as companies scale, with companies achieving high growth in the early parts of their life cycle thanks to signing on net new customers to add to a small but growing base. However, once companies reach ~$ 100 million ARR, expansion becomes the name of the game and the primary driver for growth.

Image Credits: ICONIQ

With seat-based pricing, expansion is possible, but customers who are watching their spend will put off paying for additional seats and make do with their plans as long as possible. In this paradigm, teams must effectively resell their product to existing customers to grow.

This is why companies should question the status quo and consider newer pricing models like usage-based pricing (UBP), where appropriate (i.e., depending on product, target customer type, and sales motion). UBP has gained traction over the last five years, and it’s easy to see why. By basing pricing on usage instead of the traditional licensing or by-seat models, teams are encouraged to optimize efficiency.